Head of Operations

In this post, I'll share insights I gained from my

recent week of algortihmic trading.

With just over £114 in trading capital,

I traded multiple strategies

across 10 different

instruments in various asset classes,

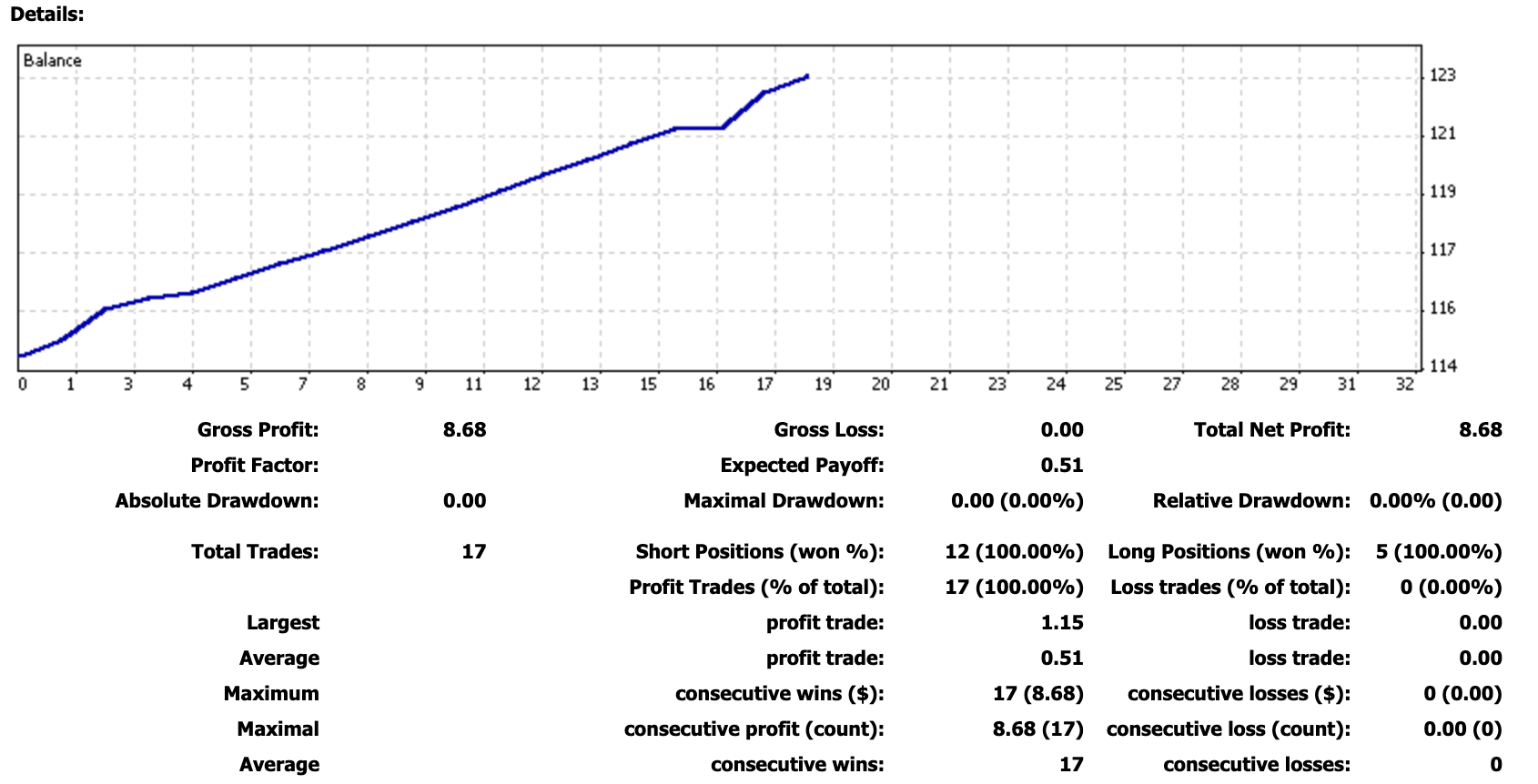

gaining a profit of just over £8.

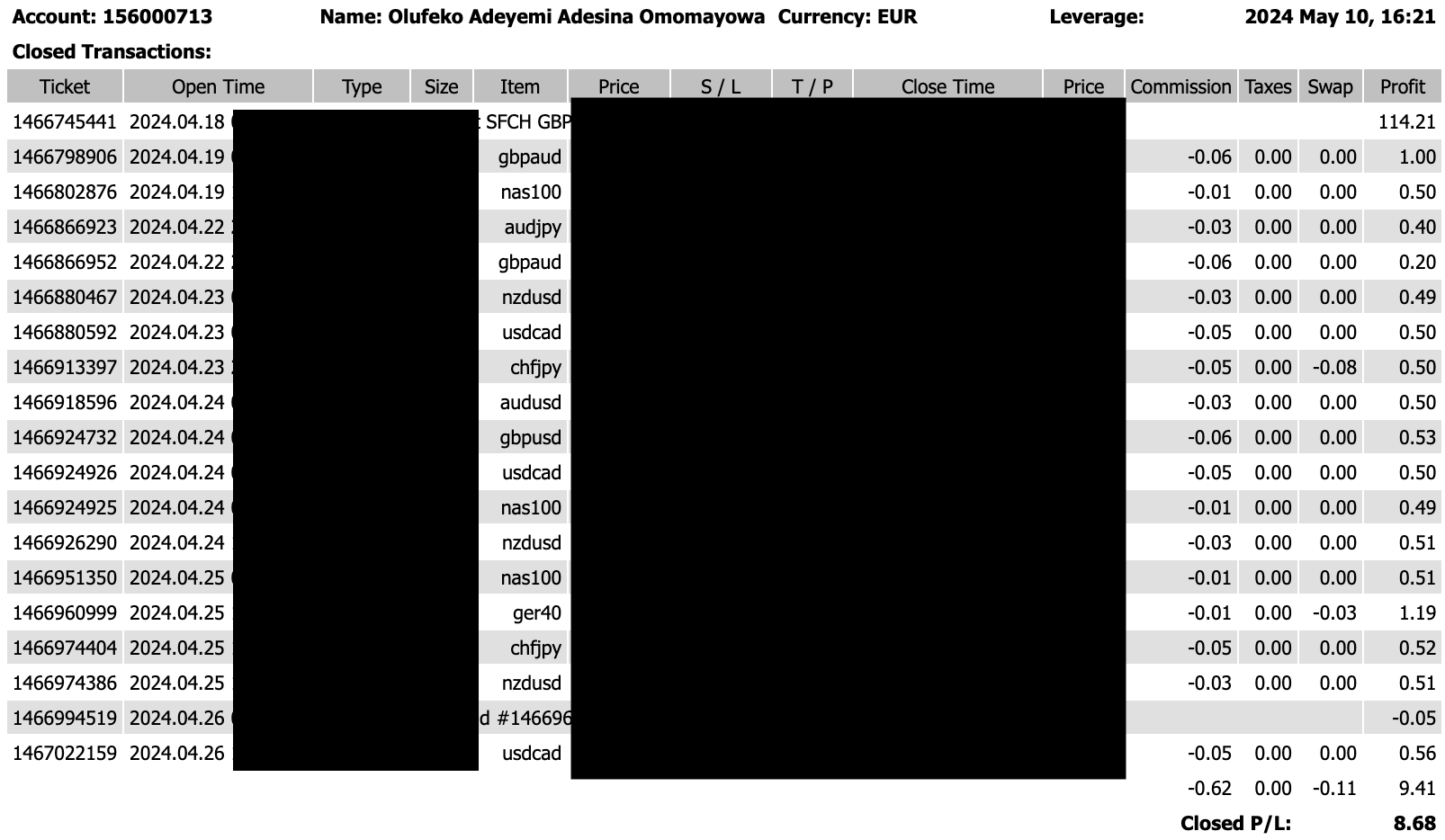

Before we get started, below is a statement showing the details

of the positions I took during the week:

Detailed report of positions from 18/06 - 26/06

Graphical representation of account levels from 18/06 - 26/06

Algortihmic trading relies on predefined rules and logic, removing emotional bias from trading decisions that is evident in manual trading. By basing trades on algortihmic models and algorithms, I maintained discipline and consistency in my approach, leading to more objective decision-making. Manual trading leaves room for emotional bias. Considering the amount of capital I was using, margin calls were easily reached. If a signal for a new trade came whilst I was still in a trade, a situation can occur where I exit this trade to enter this new trade. This can easily happen more than once, creating a domino effective that can see me reduce my account size significantly, with the hopes of trying to get every opportunity. Algortihmic trading eliminates all this and keeps the decisions ruled by the logic pre-set.

Backtesting my strategies before deploying them into the market gave me the confidence to trade with conviction. By analysing historical data, I refined my models, increasing execution quality and gaining confidence in the future performance of my trading strategies. You are not able to do backtesting with manual trading, which does not give confidence in trading decisions before they occur, only after if the strategy plays out the way it is meant to.

Automated trading eliminated the risk of human error and ensured trades were executed promptly and accurately. This efficiency was crucial in seizing opportunities and maximising profits in the fast-paced world of trading. With manual trading, I would not be able to get even close to the execution. times that automated trading provides.

Creating an automated trading system allowed me to seize opportunities across multiple markets and asset classes without being limited by human capacity. This scalability was evident in the simultaneous execution of multiple trades in 2 of the trading days, giving me the freedom to focus on other tasks while my trades were happening. With manual trading, it would have been virtually impossible to execute these trades at the same time. Manual trading would does not have the same scalability as algortihmic trading.

Access to multiple asset classes and markets enabled me to diversify my trades, reducing risk exposure across different markets. As the report shows, trading over 10 different assets within a week helped me spread my risk and navigate market volatility more effectively. With manual trading. I may have had the ability to diversity my portolfio to this level, however this would be a difficult task with the amount of assets I would have had to try and trade , linking backk back to the objective decision making that algortihmic trading provides.

Overall all of these benefits compound into the benefit of managing risk better. Giving the execution to be executed by logic and rules reduces the risk of human error. Increasing the scalability and diversification of markets and asset classes further reduces the risk associated with opening positions. Furthermore backtesting helps to give me confidence that the strategy that I have created is credible enough to put my money where my mouth is.

In summary, algortihmic trading offers several benefits, including objective decision-making, scalability, diversification, faster execution times, adaptability to market conditions, and effective risk management. By harnessing these advantages, it allows me to enhance my trading performance and navigate the markets with confidence.